OUR PROCESS

Discovery

Understanding your goals and requirements.

Strategy

Crafting a tailored cybersecurity and insurance plan.

Onboarding

Building robust security solutions.

24/7 monitoring

Bind & issue cyber insurance policy

COMPLETE-PROTECTION

Cyber Insurance

One Interface. Ultimate Protection.

Data Protection > Cybersecurity > Insurance

Cyber InsureX provides cyber insurance that protects your business from costly incidents like data breaches, ransomware, and network disruptions.

We help you recover quickly, stay financially secure, and keep your business running with confidence.

Holistic Risk Mitigation Strategy

At Cyber InsureX, we know cyber insurance is key to a strong risk strategy.Our tailored coverage protects you from legal fees, fines, and recovery costs — and our security services help prevent attacks and speed up recovery.

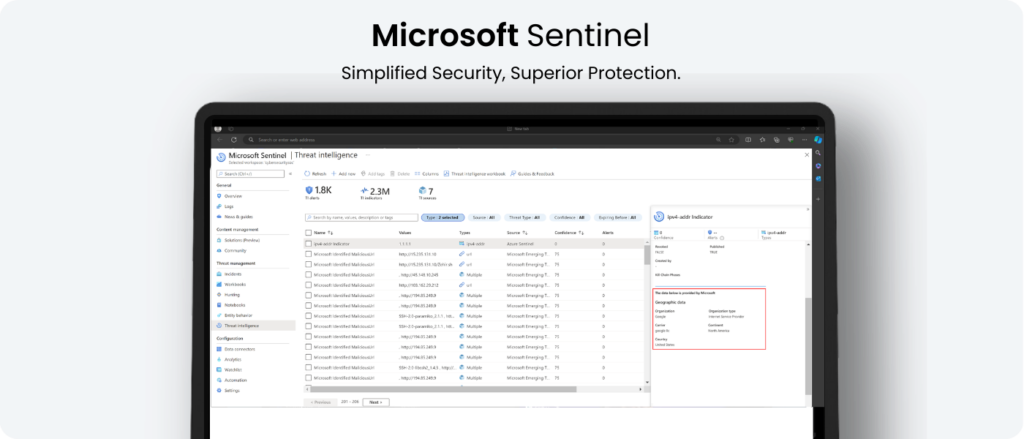

Microsoft Sentinel ingests over 65 trillion signals daily for unmatched threat visibility and faster response, backed by our team monitoring and fixing issues around the clock.

This proactive defense can even help lower your premiums, keeping your business secure, resilient, and ready for anything.

Customized Policies for Specific Needs

Cyber insurance with Cyber InsureX gives your business a vital safety net in today’s digital world.

Our customized policies cover data loss, business interruption, cyber extortion, and more — helping you recover without devastating costs.

This added layer works with your existing security to protect your operations and financial health.

Financial Resilience and Rapid Recovery

Cyber InsureX cyber insurance protects your business from the financial impact of cyber threats.

Our policies cover data breaches, system outages, and cyber extortion, so you’re shielded from costly disruptions.

With fast claims and expert support, you can minimize downtime and bounce back quickly — keeping your business stable and resilient.

Cyber Insurance

Directors & Officers

Errors & Omissions

Initial Consultation and Risk Assessment

We begin by conducting a thorough consultation to understand your business, industry, and unique needs. This includes a detailed risk assessment where we analyze the specific threats that your organization may face. Understanding the digital landscape and your vulnerabilities allows us to develop a strategy that’s tailored to your operations.

Customized Coverage Proposal

Once we have a clear understanding of your needs, we craft a customized insurance package that aligns with your business goals. Our team works with you to select the right coverage options, from data breach protection to business interruption and cyber extortion.

Continuous Monitoring and Support

Cybersecurity is not static; it requires ongoing attention. We don’t just leave you after your policy is issued. Our team stays engaged, offering continuous monitoring, updates, and support to ensure your business remains protected as new threats emerge.

You ask, we answer

If you experience a covered incident, simply notify us as soon as possible. Our team will guide you through each step, gather the necessary information, and work quickly to resolve your claim.

Your premium depends on various factors, such as the size of your business, industry risks, coverage limits, and past claims history. We always strive to offer competitive rates tailored to your needs.

Yes, you can update your coverage as your business grows or changes. We’ll help you review your policy regularly to make sure you’re always protected at the right level.

Yes, you can update your coverage as your business grows or changes. We’ll help you review your policy regularly to make sure you’re always protected at the right level.

Absolutely. Our specialists are here to answer any questions and provide expert guidance, so you feel confident about your coverage at all times.